Understanding Income Tax in Germany

Navigating the complexities of income tax can be a difficult task, but understanding the system is crucial for anyone living and working in Germany. In this article, we’ll provide a detailed overview of the income tax system in Germany, exploring its different aspects and the high possibility of tax returns at the end of the year.

The Basics of Income Tax in Germany:

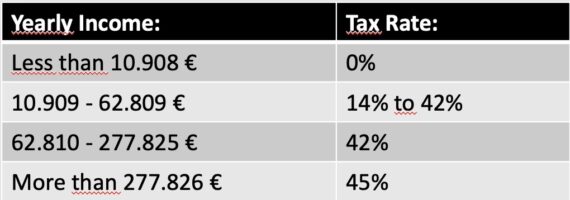

Income tax in Germany is imposed on individuals based on their income. The German income tax system operates on a progressive tax rate structure, meaning that the more you earn, the higher the tax rate applied to your income. There are currently seven income tax brackets in Germany, ranging from 0% to 45%.

Determining Taxable Income:

To determine your taxable income, you need to consider various factors such as employment income, self-employment income, rental income, investment income, and other sources of income. Additionally, deductions and allowances play a significant role in reducing your taxable income. These can include expenses related to health insurance, pension contributions, certain work-related expenses, and childcare costs.

Filing Income Tax Returns:

Income tax returns are generally filed annually in Germany. If you are an employee with only income from employment and have no other sources of income, your employer will automatically deduct taxes from your paycheck throughout the year. In this case, filing a tax return may not be necessary unless you want to claim deductions or credits.

Tax Return Possibilities and Benefits:

One of the most interesting aspects of the German income tax system is the possibility of receiving a tax refund at the end of the year. This occurs when you have overpaid taxes throughout the year or are eligible for deductions or credits that reduce your tax liability. Common deductions and credits include expenses for education, medical expenses, charitable donations, and contributions to retirement accounts.

For 2022 there is the average of 1.072 € estimated of potential amount tax return per person.

Source: Handelsblatt Link

The Role of Steuerberater (Tax Advisors):

Tax laws and regulations in Germany can be complex, especially if you have multiple sources of income or own a business. Many individuals choose to seek assistance from tax advisors, known as Steuerberater, to ensure compliance with tax laws, optimize deductions, and minimize the risk of audits.

Frequently Asked Questions:

How do I know if I need to file an income tax return in Germany?

If you have income from multiple sources, are self-employed, or wish to claim deductions or credits, it is advisable to file an income tax return. You can also use the ELSTER online portal to check if you are required to file a tax return.

What are the key documents needed for filing an income tax return?

Key documents typically include your annual salary statement (Lohnsteuerbescheinigung), bank statements, receipts for deductible expenses, and any other relevant income statements.

How long do I have to file my income tax return in Germany?

The deadline for filing income tax returns in Germany is generally May 31st of the following year. However, you can request an extension until December 31st by engaging a tax advisor.

Can I file my income tax return online in Germany?

Yes, Germany offers an online tax filing system called ELSTER. It allows you to submit your tax return electronically, reducing paperwork and streamlining the process.

What happens if I make a mistake on my income tax return?

If you realize you made a mistake on your income tax return, you can file an amended return to correct the error. It is advisable to seek guidance from a tax advisor